If you’re looking for the best adventure travel insurance comparison, I’ve got the post for you! I’m sharing my travel insurance review between SafetyWing and World Nomads.

I travel a lot, and it used to be hard to decide which travel insurance to purchase. There are tons of companies out there offering great deals, and honestly, I haven’t tried them all.

However, SafetyWing and World Nomads are two that I continue to use. Both have pros and cons and are better (or worse) for certain types of trips.

I’ve compared these two travel insurance companies for myself and thought it would be useful to share the coverage and policies with you. In doing so, I hope it helps you decide which is best for your trip, should you decide to purchase insurance, which I think is crucial.

I’m Going On An Adventure contains affiliate links and is a member of the Amazon Services LLC Associates Program. I will earn a small commission if you purchase through any qualifying links at no extra cost to you.

The Best Adventure Travel Insurance For Travelling Abroad

Overall, I prefer SafetyWing Nomad Insurance for offbeat and adventure travel.

There are a few reasons for this; however, SafetyWing has a super-easy platform and an extreme sports add-on for only $10 a month that covers most high-risk activities. Additionally, World Nomads don’t cover as many countries as SafetyWing.

That said, the biggest drawback with SafetyWing is that the benefit limit is capped at $250,000. It’s low compared to World Nomads Insurance, which starts at £5,000,000.

Key Points Summary

- Top Choices: SafetyWing and World Nomads are both highly regarded for travel insurance, especially for adventure trips.

- Best for Offbeat Travel: SafetyWing’s broader coverage of countries makes it ideal for adventurous, off-the-beaten-path destinations.

- Coverage Limits: World Nomads offers higher coverage, especially for medical expenses, but SafetyWing is more affordable with a lower coverage cap.

- Extreme Sports: Both companies offer adventure sport add-ons, but SafetyWing’s options are cheaper and more straightforward.

- Tech Gear Coverage: SafetyWing offers better coverage for high-value tech items, but World Nomads also offers good coverage, especially under the Explorer plan.

- Policy Flexibility: SafetyWing offers a flexible monthly payment option and 10% off the yearly plan, while World Nomads is more comprehensive but requires an upfront payment.

- Exclusions: Both companies have exclusions based on travel and health warnings, so it’s essential to review policy details carefully.

Comparison: SafetyWing vs. World Nomads

| FEATURE | SAFTEYWING | WORLD NOMADS |

| Coverage Limit | $250,000 | £5,000,000 (standard) and £10,000,000 (explorer) |

| Extreme Sports | Add-on $10 per month | Included level 1 sports with options to upgrade |

| Country Exclusions | Russia, Cuba, Belarus, Iran, North Korea, and Select regions of Ukraine | Varies by country, check during quote |

| Tech Gear Coverage | Up to $1,000 per item ($3,000 cap) | Up to £400 per item (standard) to £750 per item (explorer) |

| Cost Example (4 Weeks) | Starting from $56.28 (ages 10-39) | £150+ for standard plan |

| Policy Flexibility | Monthly payment, amenable mid-trip. | Single or multi-trip with extension options |

| Customer Support | Online chat, fast responses | Excellent customer service |

| Travel Warning Impact | Affects evacuation and medical coverage | Affects evacuation and medical coverage |

SafetyWing and World Nomads are my go-to travel insurance companies for adventure trips, group travel and solo travel. Although there are slight variations between them, they offer similar policies.

Below, I’m digging deeper into each policy to help understand the differences between the two.

Disclosure: All the information is based on purchasing a policy from the UK. I’ve written this adventure travel insurance comparison to the best of my knowledge and understanding. However, changes to insurance policy terms can happen. Use the information within this article at your own discretion. Before purchasing a policy, do your own research and make sure all your personal needs will be covered!

SafetyWing Nomad Insurance

Best for quick and affordable coverage around the world.

For most of my trips, I tend to use SafetyWing. I find purchasing insurance from their website super easy and fast, and I know I’m getting covered by a reliable company for up to $250,000.

What do you get?

The starting package is set at $56.28 for 4 weeks for anyone aged 10-39. It does increase the older you get…go figure. The cut-off age is 69.

Included are the cost of unforeseen medical emergencies and a selection of unforeseen travel-related costs. The insurance works while you’re outside your home country and for medical coverage during short visits home.

- The great thing about the SafetyWing Nomad Travel Insurance is their adventure sports/activities add-on. For $10 extra a month, this SafetyWing policy will include activities such as skydiving, scuba diving, motorbiking (perfect for those scooter adventures around Asia!), mountaineering, whitewater rafting, and quad biking, plus many, many more. There’s a complete list of activities here.

- SafetyWing covers pretty much all the countries in the world, with the exception of Russia, Cuba, Syria, Belarus, Iran, and North Korea (as well as select regions of Ukraine, Luhansk, Donetsk and Crimea). This is superb for me as it means I can use SafetyWing to visit offbeat and adventurous destinations, knowing I’m going to be fully covered.

- Other add-ons include electronic cover (think laptops, tablets and cameras) for up to $1,000 per item ($3,000 in total) and US coverage for travel to the US and US territories.

This world coverage, coupled with the above adventure sports add-on, makes it my favourite travel insurance for adventure destinations and activities.

Why I love them

The application process for purchasing the actual insurance is straightforward and clear. Each step clearly identifies what’s included, as well as additional add-ons and costs. I love how transparent the company is. I have never felt like there are hidden costs or that SafetyWing is being vague about what’s included (and what’s not included) when purchasing my own insurance.

They also have a 4-week recurring policy, which is great when travelling long-term because I never really know how long I’ll be travelling for! The policy is paid monthly rather than in one go, which I also find helpful, and it’s amendable.

It can also be bought while overseas, which is a great feature for those of you who have not yet purchased insurance but are already travelling!

Another huge positive is their customer support team. There’s an online chat box that puts me in contact with a real person every time I have a query. Reply time has always been on the same day, and my questions are always answered.

🌟 My top pick >> If you’re interested in purchasing an affordable insurance policy for travel and adventure activities from SafetyWing, you can do so here.

Things to watch out for

You should be aware of a few caveats: always read the policy terms and conditions. However, three of the main exclusions are as follows:

- If a country has a Travel Warning in place, the benefit of evacuation from local unrest will be directly affected. For example, when I visited Mauritania, the coverage for evacuation was excluded due to the country having an FCDO travel warning in place.

- If a country has a Health Warning in place, the benefit of coverage for medically necessary treatment of unexpected injuries/illnesses is affected and triggers this exclusion: Any illness or injury resulting from an epidemic, pandemic, public health emergency, natural disaster, or other disease outbreak. Except what is described in the section called “COVID-19” (exclusion 4).

- It’s also worth noting that coverage for claims that someone is holding you financially responsible for (Liability), cash payout if you lose limbs or eyes in an accident (accidental dismemberment), and cash payout to your beneficiary (accidental death) are excluded if caused by terrorism, war, or an act of war.

How can you check if a country has a travel warning or health warning in place?

The types of Travel Warnings that apply in this explanation are:

- The US Department of State issues a level 3 or level 4 travel advisory.

- The Foreign, Commonwealth & Development Office advises against travel to the destination.

The types of Health Warnings that apply in this explanation are:

- ·The United States Centers for Disease Control & Prevention (CDC) have issued a Warning Level 3 (Red) for the location/country or worldwide.

- ·The World Health Organization (WHO) has issued advice against travel to the area or country.

⭐ Pro tip >> If a Travel Warning or Health Warning is issued after your arrival, you must contact SafetyWing within 10 days of the issue to benefit from it and make a claim.

Things I don’t like about SafetyWing Nomad Insurance

The biggest drawback is the overall benefit limit. $250,000 is much lower than many other insurance companies’ limits, but this is reflected in the low cost of the policy.

Furthermore, the cap at $1,000 per tech item (which is capped at a yearly limit of $3,000) is also a concern for me when travelling as this doesn’t cover my laptop, which is a huge necessity for me to travel with.

That said, the limit is slightly higher compared to World Nomads. Still, if you’re travelling with a lot of expensive tech gear, this policy might not be the best option.

World Nomads Single Trip Insurance

Best for comprehensive RTW travel

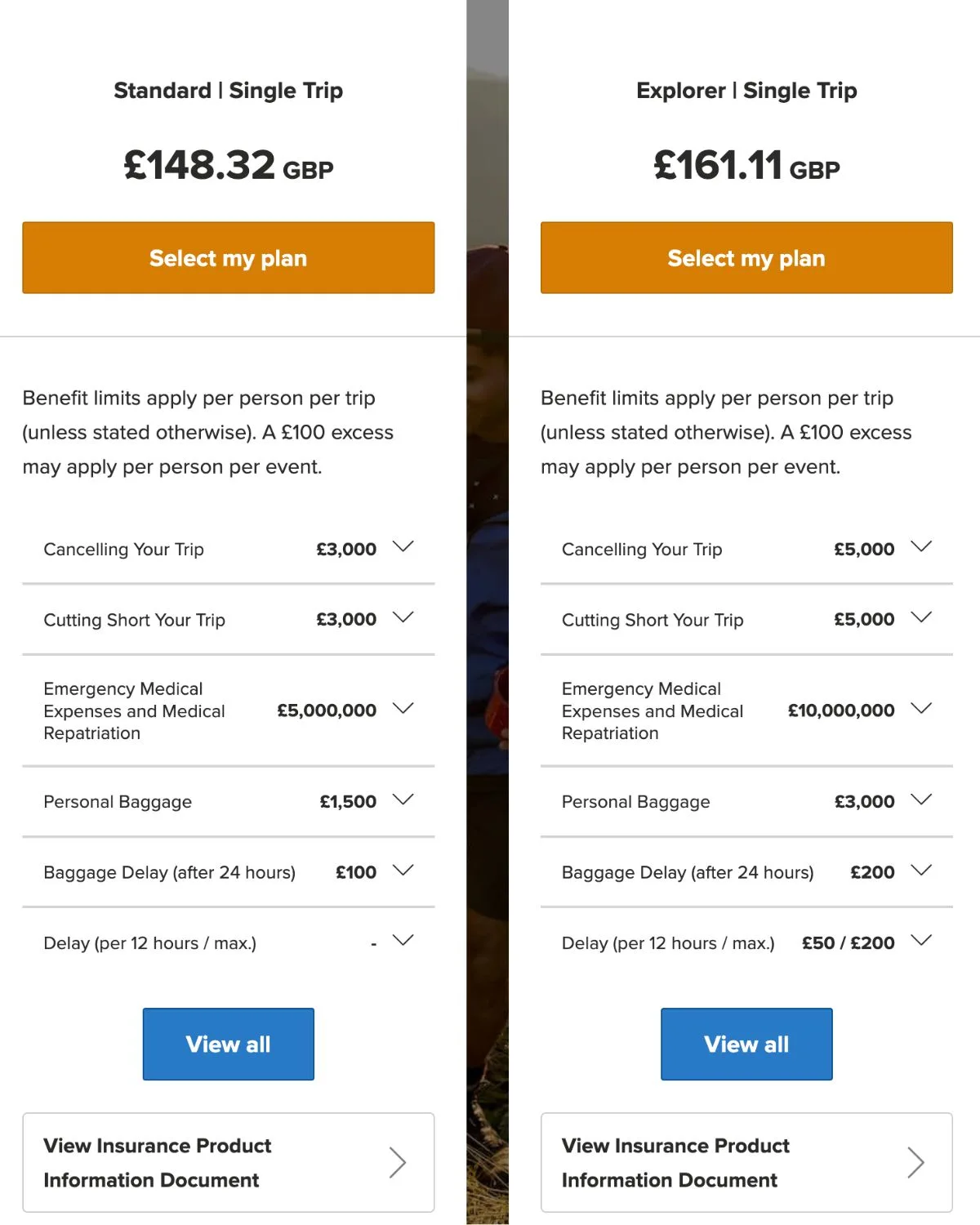

World Nomads has been around since 2002 and is a well-established insurance company. They focus on adventure travel and backpackers, offering two plans: Standard and Explorer for those aged 69 and younger.

What do you get?

It works a little differently from the SafetyWing Nomad insurance, as I have a choice between the Single-trip cover and the Multi-Trip Annual cover. (The single-trip cover is best compared to SafetyWing Nomad Insurance).

Then there’s also the option between the Standard plan and the Explorer plan—the Explorer plan offers a higher policy limit and more benefits, but it does cost more. In the past, I’ve chosen the Explorer plan since it offers a higher limit for tech gear compared to the Standard.

- Standard: High-value items up to a maximum of £1,200.00 for all items, with a £400.00 limit per item.

- Explorer: High-value items to a maximum of £2,250.00 for all items, with a £750.00 limit per item.

- Keep in mind that there are some excluded items that World Nomads won’t cover.

The cost of the policy depends on the duration of the trip and the countries visited. I’ve noticed it usually starts around £150 + for a month-long trip on the Standard plan (see the example below).

🌟 To find out exactly how much the policy will cost, enter the trip details, such as destinations and length of trip, to receive an instant quote.

⭐ Good to know >> The Single-trip policies cover travel outside the UK only. Annual multi-trip policies cover multiple trips taken within your chosen region during the policy period.

Let’s start with the single-trip cover

The maximum trip duration is 365 days and can be used for multiple countries. The great thing about this policy is that coverage can be extended mid-trip. It offers a benefit limit of up to £5,000,000 (Standard plan) and £10,000,000 (Explorer plan) on overseas emergency medical expenses.

- The benefit limits are quite high compared to SafetyWing, but this is reflected in the price. It’s flexible coverage with fewer restrictions, simplicity, and commitment. I have used this Single-trip policy numerous times for my round-the-world backpacking trips.

- The cover offers flexibility in customising coverage and destinations, allowing you to tailor the policy to fit the specifics of your trip.

- Sports and adventure activities are included in the Level 1 tier of the travel insurance. You can see the full list of activities covered here. Some of these Level 1 activities include whitewater rafting, caving, go-karting, hiking (up to 3,000 metres), horse riding, parasailing, snorkelling, and scuba diving.

One of the best things about World Nomads travel insurance is that the policy can be upgraded to include higher-level adventure activities. Activities that fall into Level 2 or above, such as boating, cycling, glacier walking, jet skiing, moped riding under 125cc, and outdoor rock climbing, can all be added for a premium.

What about the multi-trip annual cover?

It’s insurance coverage for multiple trips within a 12-month period in select regions: Europe and Worldwide. Again, there is the option of the Standard plan or Explorer plan, the latter being the most comprehensive cover.

- It’s a great option for frequent flyers who want to make multiple trips within the year.

- Each trip has a duration limit, and you’ll have to return home after each journey. For example, the Standard plan covers up to 31 days per trip, and the Explorer plan covers up to 45 days per trip, so I’m able to make multiple trips within the year.

There are more benefits, such as convenience, cost-effectiveness, and domestic travel. Under-18s also have free coverage when travelling with an adult. However, I would only use this option if I was planning shorter, multiple trips within the year. Since most of my trips are for longer periods, I haven’t needed to use the multi-trip annual cover personally yet.

It’s worth investigating further if you’re a frequent flyer.

Why I love them

The first time I used World Nomads was in 2015 when I travelled around South America. At the time, I got a great deal and found their coverage ideal for the activities and countries I was planning to visit.

A few years later, I took another backpacking trip, this time across Southeast Asia and Central America. Given my positive experience with World Nomads, I decided to use them again. Partway through my trip, I needed to adjust my plans—adding new destinations. I contacted their customer service team and explained my situation. They were incredibly helpful, guiding me through the process of adjusting my policy.

In the end, I received a full refund on my existing policy once I had arranged a new one that suited my revised itinerary. This level of customer service is rare and one of the key reasons I keep coming back to World Nomads.

Another reason I love World Nomads’ coverage is the high benefit limit. When you’re backpacking, especially in regions like South America or Southeast Asia, unexpected things can happen—whether it’s a medical emergency or theft. The comprehensive coverage, with high limits for emergency medical expenses and high-value items, ensures that I’m well-protected even in the most remote areas.

Things to watch out for

Much like the exclusions with SafetyWing, the same travel warnings and health warnings impact a World Nomads insurance policy. Some of the more off-beat countries, such as Mauritania, are also not covered by World Nomads. However, this will be highlighted during the first steps of creating a quote when destinations need to be entered.

It’s essential to read the policy terms and conditions to understand what is (and isn’t) fully covered.

Things I don’t like about World Nomads Single Trip Policy

One of the biggest drawbacks is the upfront payment. It’s usually manageable if I’m taking a shorter trip, but for longer journeys, it can be quite a hefty fee and requires some financial preparation.

Even with the Explorer plan, the £750 cap per item on tech gear is still not enough to cover certain items. Interestingly, this is about the same as SafetyWing, but it causes me concern when I’m travelling with all my gear.

The need for repeat purchases can also be annoying if, say, I decide to change my trip and add destinations. As I mentioned above, this was the issue I had when I needed to change the policy. Luckily, I was able to do this, but I had to provide proof of my new insurance through World Nomads to get the refund. I wouldn’t have been able to do this if I had chosen another company.

There’s also no coverage for domestic travel on the single-trip policy.

You might also be interested in

- Hitching a ride on the iron ore train in Mauritania

- Spending 4 days in Caratagena’s quaint city in Colombia

- Riding a scooter around the the island of Gods

- Taking a road trip around the lakes of Northern Italy

The Wrap: The Best Adventure Travel Insurance

SafetyWing is the best option if you’re seeking affordable, flexible coverage for a wide range of countries, especially for spontaneous or long-term travel. Its travel adventure sport add-on is a bonus for adrenaline seekers, although the insurance coverage limits might be lower than you’d find elsewhere.

World Nomads is ideal if you’re looking for comprehensive coverage with higher benefit limits, particularly for medical expenses. It’s the perfect insurance for round-the-world trips with extensive adventure sports and higher tech, but be prepared for a higher upfront cost.

Ultimately, the choice depends on your travel style: opt for SafetyWing if you prioritise affordability and flexibility, or go with World Nomads for more extensive coverage and benefits tailored to adventure travellers.

Explore & Discover More

Come and join our socials and keep up to date with the latest adventures. Find the latest travel blogs and photo updates, ask questions and get travel inspiration.

✔️ FIND ON INSTAGRAM

✔️ JOIN US ON FACEBOOK